29+ mortgage underwriter process

Web Mortgage underwriting is the process through which a lender evaluates the risk of approving you for a mortgage. Heres what to expect.

Premium Vector Real Estate Mortgage Agreement Home Developer Property Concept Flat Illustration Vector

Web The mortgage underwriting process happens after youve entered a purchase agreement with the seller and submitted a mortgage application.

. It involves a review of every aspect of your financial situation and. Get Access to the Largest Online Library of Legal Forms for Any State. Web The mortgage underwriting process can take anywhere from a few days to weeks.

Web The mortgage underwriting process often considers the following factors. Apply for a mortgage The first step is. Web 5 steps to the mortgage underwriting process The underwriting process for home loans has five basic steps.

Ad See If Youre Eligible for a 0 Down Payment. Your loan type financial situation missing paperwork and issues with. Find Jobs Near You.

Web Mortgage underwriting is the process a lender uses to determine if the risk of offering a mortgage loan to a particular borrower under certain parameters is acceptable. Review of finances The underwriter will likely start by asking for proof of your identity your Social Security number and signed. Ad Search Millions of Job Listings.

Web The process in which they assess your ability to do that is called underwriting. Web The underwriting process can depend on the type of loan youre applying for. During this analysis the bank credit union or.

Web 2 Processing your application Your lenders processing team reviews your documents and orders the home appraisal and any additional documentation necessary. Ad Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. Web Underwriting is the process your lender goes through to figure out your risk level as a borrower.

Calculate Your Monthly Loan Payment. Many or all of the products featured here are from. Web The process has four key steps.

Web Loan underwriters review information such as your income credit score debt-income ratio and other assets. Web An underwriter will take an in-depth look at your credit and financial background in order to determine your eligibility. Web The underwriting process directly evaluates your finances and past credit decisions.

Web The loan underwriting process not only assesses your creditworthiness and ability to repay a mortgage but it also verifies that you and the property meet all. Apply to Jobs w One Click. Web Underwriting is the process through which an individual or institution takes on financial risk for a fee.

Web The underwriting process timeline and outcomes Underwriting can take anywhere from a few days to a few weeks depending on how quickly you turn around. Answer Simple Questions See Personalized Results with our VA Loan Calculator. Debt-to-income Underwriters analyze what percentage of your monthly income youll be spending on.

Conventional loans Most of these loans use automatic underwriting but manual. Web Underwriting is the part of the mortgage process when your lender verifies your financial information to confirm that you qualify for a loan. New Jobs Posted Daily.

When applying for a mortgage underwriters will. This risk most typically involves loans insurance or investments. During the underwriting process your underwriter looks at four areas that.

The bank credit union or mortgage lender youre working with will assign.

Holly Rowland Senior Underwriter Angel Oak Mortgage Solutions Linkedin

The Mortgage Underwriting Process A Complete Guide

7 Underwriting

What The Mortgage Underwriting Process Looks Like Youtube

Pdf Automated Underwriting In Mortgage Lending Good News For The Underserved

Mortgage Underwriting Bills Com

:max_bytes(150000):strip_icc()/understanding-the-mortgage-underwriting-approval-process-2395236_final-a045fb3a570b448593cb32da8a15cecb.png)

The Mortgage Underwriting Approval Process

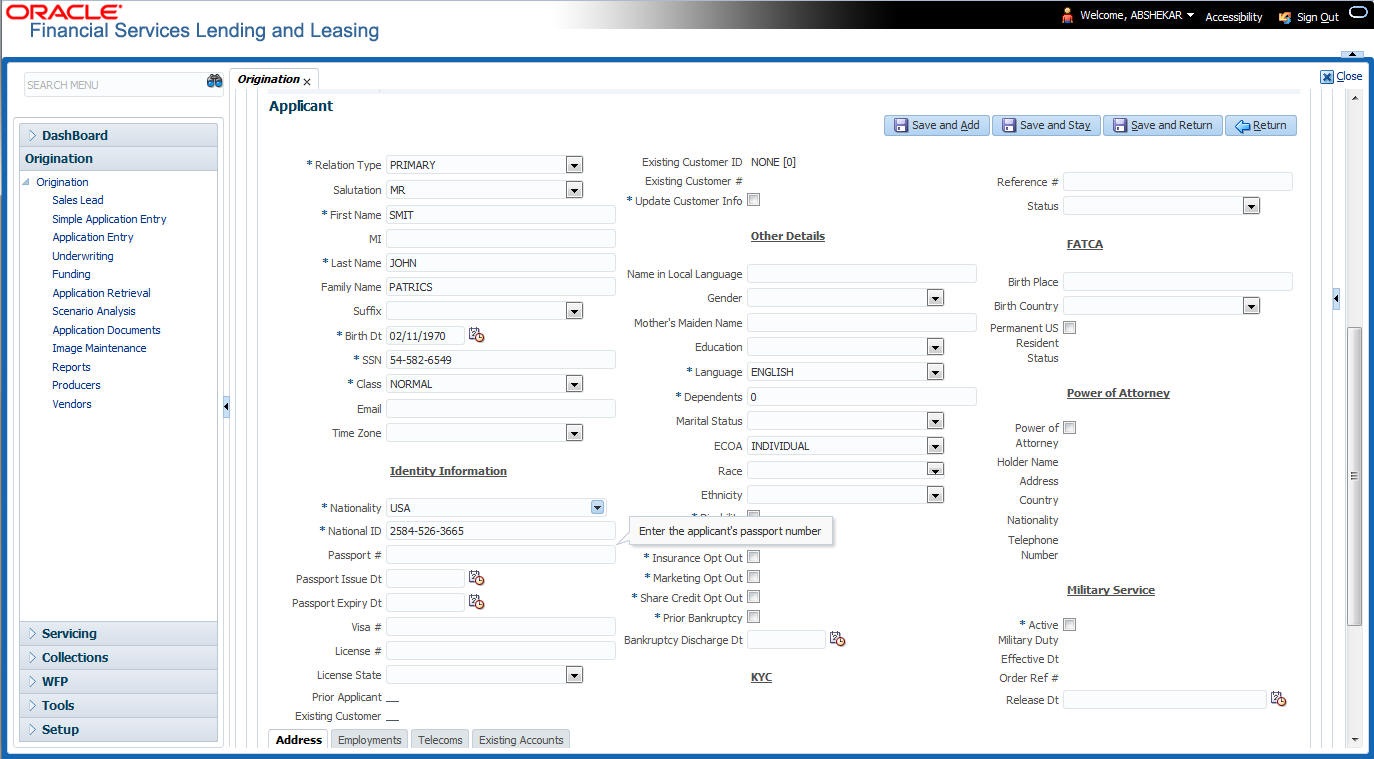

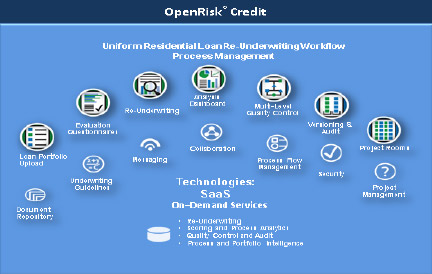

Mortgage Credit Re Underwriting Work Flow Process Management Newoak

Business Succession Planning And Exit Strategies For The Closely Held

The Mortgage Underwriting Process A Complete Guide

Department Highlight Underwriting

Amanda Mcnally Senior Vice President Senior Compliance Manager Independent Testing And Validation Wells Fargo Linkedin

Mortgage Underwriting Process How It Works And What To Expect

Understanding The Mortgage Underwriting Process Embrace Home Loans

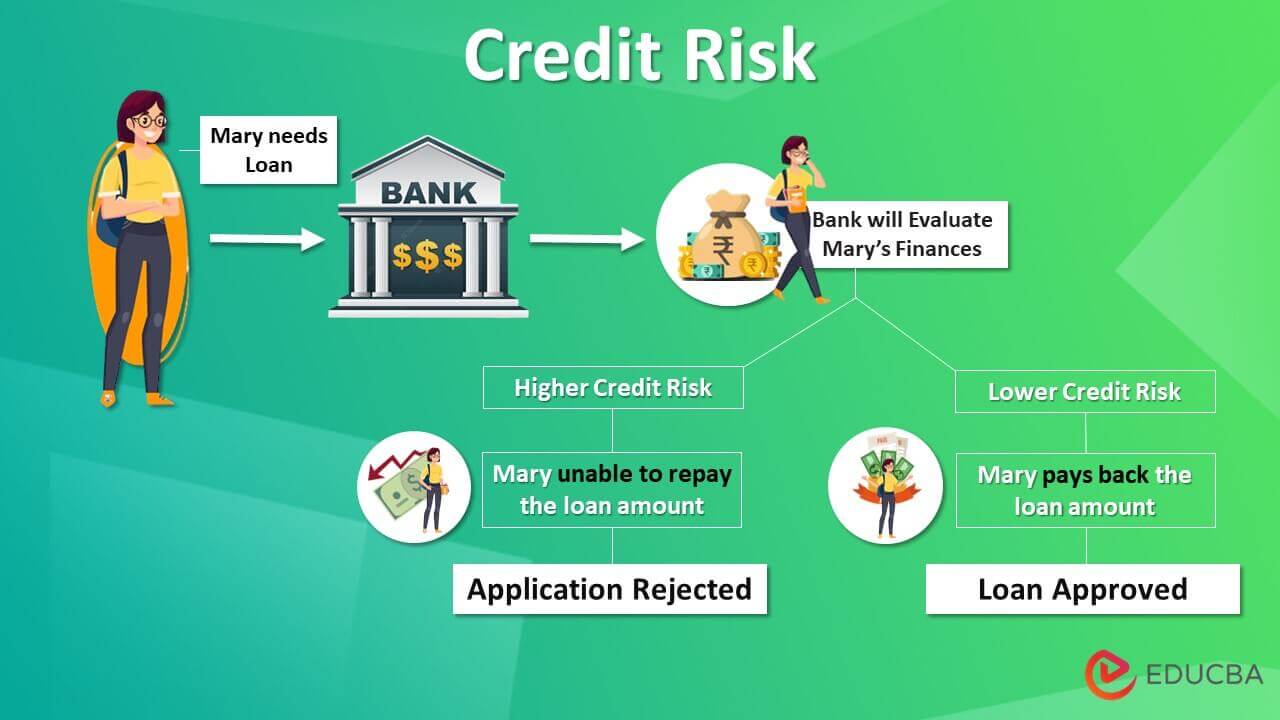

Credit Risk How To Measure Credit Risk With Types And Uses

Understanding The Mortgage Underwriting Process Embrace Home Loans

What Is The Mortgage Underwriting Process And How Does It Work